Everything You Need to Know About Foreclosed Homes: Options and Costs

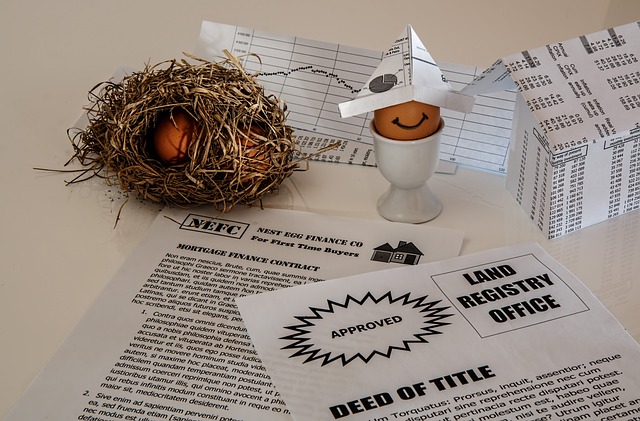

Foreclosed homes in the US can offer below-market prices, but buyers must assess full costs in USD — purchase price plus back taxes, liens, repair estimates, inspections, and closing fees. This guide explains bank-owned (REO) and auction purchases, financing options, common risks, and practical tips to compare total costs and identify reputable service providers.

Foreclosed properties represent a significant segment of the real estate market, offering potential savings for informed buyers while presenting unique challenges that require careful consideration. The foreclosure process occurs when homeowners default on their mortgage payments, leading lenders to reclaim and sell the property to recover their losses.

How Much Does a Foreclosed Home Cost and What Factors Affect the Price?

The cost of foreclosed homes varies significantly based on multiple factors including location, property condition, market demand, and the stage of foreclosure. Generally, foreclosed properties sell for 20-30% below market value, though this discount reflects the property’s condition and potential repair needs.

Key pricing factors include the property’s physical condition, neighborhood desirability, local market conditions, and competition from other buyers. Properties requiring extensive repairs may offer deeper discounts but come with higher renovation costs. Location remains crucial, as foreclosed homes in desirable areas maintain higher values despite their distressed status.

The foreclosure timeline also impacts pricing. Pre-foreclosure properties may offer better negotiating opportunities, while bank-owned properties often have fixed pricing with limited flexibility. Auction properties can sell below or above estimated values depending on bidding competition.

Foreclosed Properties: Main Purchase Options Available

Buyers can acquire foreclosed properties through several distinct channels, each with unique processes and requirements. Pre-foreclosure purchases involve negotiating directly with distressed homeowners before the foreclosure process completes, often through short sales approved by lenders.

Foreclosure auctions represent another acquisition method, where properties sell to the highest bidder on courthouse steps or online platforms. These sales require cash payments and offer no inspection opportunities, making them suitable for experienced investors with ready capital.

Bank-owned properties, also called REO (Real Estate Owned) properties, become available after unsuccessful auctions. These properties offer more traditional purchase processes with financing options and inspection periods, making them accessible to conventional buyers.

Government-owned foreclosures, including HUD homes and VA foreclosures, provide additional opportunities with specific buyer requirements and potential financing assistance for qualified purchasers.

Bank-Owned Properties (REO) and the Buying Process

Real Estate Owned (REO) properties represent the most buyer-friendly foreclosure option, as banks have already reclaimed these properties and prepared them for resale. The REO buying process resembles traditional real estate transactions but includes specific considerations and procedures.

Banks typically hire real estate agents to market REO properties, allowing buyers to schedule inspections and submit offers through standard channels. However, banks often require pre-approval letters and may have specific contract terms, including as-is sale conditions and extended closing timelines.

REO properties may qualify for conventional financing, FHA loans, or VA loans, making them accessible to buyers without cash reserves. Banks sometimes offer seller financing or accept lower down payments to expedite sales and reduce carrying costs.

The negotiation process differs from traditional sales, as banks focus on net proceeds rather than emotional factors. Multiple offer situations are common, and banks may counter all offers simultaneously or request highest and best offers from competing buyers.

Key Risks and Considerations Before Buying

Purchasing foreclosed properties involves specific risks that buyers must understand and mitigate. Property condition represents the primary concern, as foreclosed homes may suffer from deferred maintenance, vandalism, or intentional damage by previous owners.

Title issues can complicate foreclosed property purchases, including outstanding liens, unpaid taxes, or legal challenges to the foreclosure process. Buyers should conduct thorough title searches and purchase title insurance to protect against these risks.

Financing challenges may arise due to property condition or appraisal issues. Lenders may require repairs before closing or refuse to finance properties in poor condition, forcing buyers to seek alternative financing or pay cash.

Market timing affects foreclosed property values, as economic downturns that increase foreclosure rates may also depress property values. Buyers should research local market trends and consider long-term holding strategies rather than quick resale plans.

Comparison of Costs and Service Providers in the Foreclosure Market

Understanding the various costs and service providers in the foreclosure market helps buyers make informed financial decisions. Different acquisition methods involve varying expense structures and professional service requirements.

| Service Type | Provider Examples | Cost Estimation | Key Features |

|---|---|---|---|

| Real Estate Agent | Coldwell Banker, RE/MAX, Keller Williams | 3-6% commission (seller pays) | REO property expertise, market knowledge |

| Home Inspection | Pillar to Post, AmeriSpec, BrickKicker | $300-$600 | Detailed property condition assessment |

| Title Services | First American, Old Republic, Stewart Title | $500-$1,500 | Title search, insurance, closing services |

| Property Management | Invitation Homes, American Homes 4 Rent | 8-12% monthly rent | Tenant placement, maintenance, rent collection |

| Renovation Contractors | Local contractors, HomeAdvisor network | $50-$150 per sq ft | Property rehabilitation, permit handling |

| Auction Services | Auction.com, Hubzu, RealtyBid | 5-10% buyer premium | Online bidding platforms, property research |

Prices, rates, or cost estimates mentioned in this article are based on the latest available information but may change over time. Independent research is advised before making financial decisions.

Additional costs include property taxes, homeowners insurance, utility connections, and potential HOA fees. Buyers should budget for immediate repairs, ongoing maintenance, and carrying costs during renovation periods. Professional consultations with real estate attorneys, accountants, and contractors help buyers understand total investment requirements and potential returns.

Understanding the Complete Investment Picture

Successful foreclosed property investment requires comprehensive financial planning beyond the purchase price. Buyers must account for acquisition costs, renovation expenses, carrying costs, and potential market fluctuations when evaluating investment potential.

Due diligence becomes especially important with foreclosed properties, as limited disclosure requirements and as-is sale conditions transfer more risk to buyers. Professional inspections, contractor estimates, and market analysis help buyers make informed decisions and avoid costly surprises.

Financing options vary significantly between foreclosure types, with some requiring cash purchases while others accept conventional loans. Buyers should explore all available financing options and understand lender requirements before committing to specific properties or acquisition strategies.

Foreclosed properties can provide excellent investment opportunities for prepared buyers who understand the risks, costs, and processes involved. Success requires patience, thorough research, adequate capital reserves, and realistic expectations about renovation timelines and market conditions.